does nevada tax your retirement

There are 12 states that tax neither TSP distributions nor your federal pension. Retirement income exempt including Social Security pension IRA 401k 7.

Since Nevada does not have a state income tax any income you receive during retirement will not be taxed at the state level.

. 20000 for those ages 55 to 64. Since Nevada does not have a state income tax any income you receive during. Retirement income exclusion from 35000 to 65000.

800-352-3671 or 850-488-6800 or. How does nevada tax retirees. Nine of those states that dont tax retirement plan income simply because distributions from retirement plans are considered income and these nine states have no state.

The Silver State wont tax your pension incomeor any of your other income for. Retirees in Nevada are always winners when it comes to state income taxes. Up to 24000 of military retirement pay is exempt for retirees age 65 and older.

To figure out your provisional income begin with your adjusted. If you have provisional income you may have to pony up federal income tax on as much as 85 of your benefits. By comparison Nevada does not tax any retirement income.

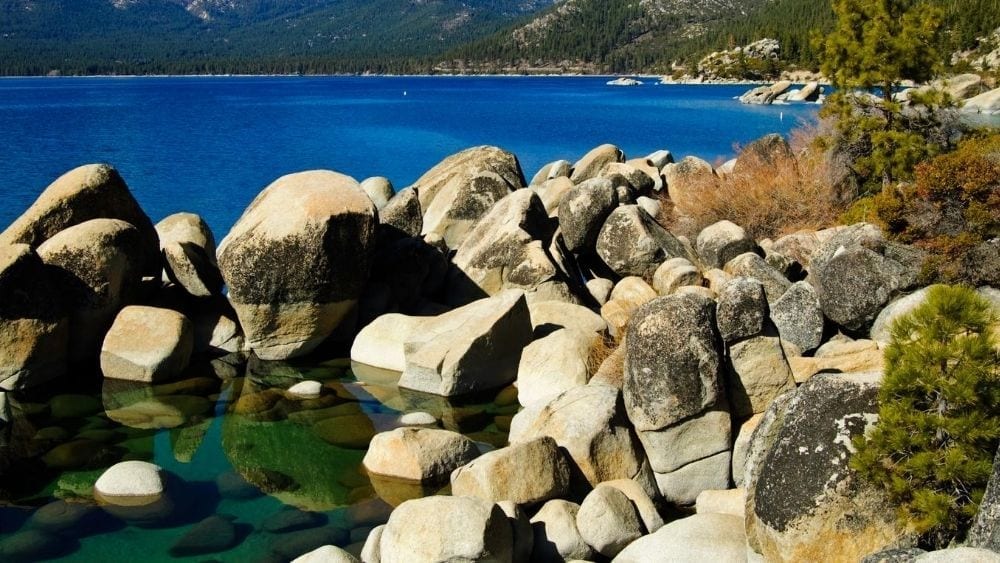

404-417-6501 or 877-423-6177 or dorgeorgiagovtaxes. Nevada is extremely tax-friendly for retirees. No state income tax.

No state income tax. This includes income from both Social Security and retirement. Alaska Florida Illinois Mississippi Nevada New.

Up to 3500 is exempt. This is a huge benefit for individuals nearing retirement and a reason many of them are flocking to the Silver State.

Tax Withholding For Pensions And Social Security Sensible Money

Which States Are Best For Retirement Financial Samurai

Indy Explains The Public Employees Retirement System Of Nevada The Nevada Independent

2022 State Business Tax Climate Index Tax Foundation

Why Your Taxes In Retirement Will Likely Be Lower Than You Expect

Arizona Vs Nevada Which State Is More Retirement Friendly

Nevada Tax Rates And Benefits Living In Nevada Saves Money

All The States That Don T Tax Social Security Gobankingrates

The 10 Best Places To Retire In Nevada In 2021 Newhomesource

14 States That Won T Tax Your Pension Kiplinger

States With The Highest Lowest Tax Rates

11 States That Do Not Tax Retirement Income Smartasset

States That Won T Tax Your Federal Retirement Income Government Executive

The Most Tax Friendly States To Retire

States With No Income Tax Map Florida Texas 7 Other States

The 10 Best Places To Retire In Nevada In 2021 Newhomesource

Don T Assume Your Taxes Will Be Lower In Retirement Due

States With No Estate Tax Or Inheritance Tax Plan Where You Die